Financial markets analysis provided by Eric Shea, Financial Markets Strategist at Exness.

What to watch

- Nvidia: Gross margins on the Blackwell and Vera Rubin platforms, and any signs of regulatory scrutiny over its OpenAI relationship.

- Apple and Meta: Early sales and user engagement data for smart glasses. Siri’s upcoming upgrade for Apple’s “Project Linwood” will be a major signal of AI maturity.

- Objective (European Union): Legal rulings in Spain and France in late 2025 could completely redefine its European business model.

- Macro: View the US Nonfarm Payrolls report. Continued weakness may increase recession risks and shift investors’ focus from optimism about valuation to deteriorating earnings.

NVIDIA’s AI Empire: Consolidating the Moat or Building a House of Cards?

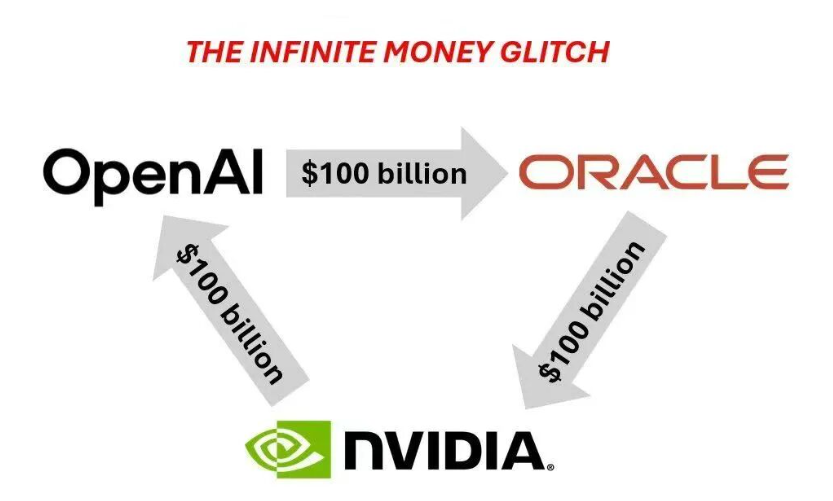

Nvidia recently announced a strategic cooperation intention, and plans to invest up to $100 billion in OpenAI. This investment is closely linked to the deployment of at least 10 GW of Nvidia systems, with the aim of supporting OpenAI’s next-generation AI infrastructure, with the first phase using its Vera Rubin platform by 2026. This is not just an investment; It is a self-reinforcing business cycle. Nvidia provides funding to OpenAI, and OpenAI then uses these funds to purchase Nvidia’s core products (GPUs, networking systems), thus effectively securing a large, long-term order channel, and injecting strong momentum into revenue growth for both parties.

Strategically, the move also helps Nvidia defend its moat by discouraging OpenAI from developing its own chips or turning to competitors like Broadcom, which already has a $10 billion order from OpenAI.

This investment could also be seen as a defensive move, aimed at preventing OpenAI from developing its own custom chips or deepening its cooperation with competitors such as Broadcom, with which OpenAI has already signed a $10 billion order.

Apple’s Business Transformation: From Vision to Sight

Apple is reportedly pausing development of the next Vision Pro to focus on it Smart glasses powered by artificial intelligence. The Vision Pro’s high price, limited ecosystem, and physical limitations limited its mass-market appeal.

This pivot points to Apple’s practical realization: The path to mainstream adoption lies in lighter, more accessible devices. The company is now developing two models — a simpler version tied to the iPhone and a standalone display model that competes directly with Ray-Ban’s Meta line.

This move does not give up spatial computing; It redefines it. The challenge for Apple now is to prove that it can turn “Apple Intelligence” into a truly competitive AI platform rather than trying to catch up to Google and OpenAI.

Meta’s Ambitious: Hardware software with kernel defense.

Meta is still ahead in the consumer AI hardware race. Its partnership with Ray-Ban has already produced several generations of smart glass, the latest of which is Ray-Ban offer Priced at about $800.

But while it is a leader in innovation, Meta faces existential threats in Europe. more 80 Spanish media companies I submitted a A lawsuit worth 550 million eurosIt was joined by similar works in France. Its “consent or pay” model also faces scrutiny under the law General Data Protection Regulation and Digital Services Act (DSA).

For Meta, hardware isn’t just a growth strategy, it’s survival. The company’s ad-based revenue model is under attack, pushing it to build new ecosystems where it controls databases and monetizes. Smart glasses and augmented reality platforms could become their own next world, protecting them from strict regulatory restrictions in Europe.

Microsoft’s quiet restructuring of the future of its AI center

While Apple and Meta compete for consumer dominance, Microsoft is working to strengthen its position through structural change.

The company has revised leadership and hiring Judson Althoff To lead business operations Satya Nadella Can focus on AI engineering and product innovation. Meanwhile, Pavan Davuluri He now oversees all Windows engineering – a move designed to accelerate the shift toward “Agent operating system”A system based on artificial intelligence that performs tasks independently.

Instead of chasing new hardware, Microsoft is integrating AI deeply into its core businesses — Azure, Windows, and Microsoft 365. Its success will be measured by Consuming AI in Azure, Co-pilot subscriptionsAnd a higher license value for the organization. It’s a defensive but powerful approach: using AI to enhance, not reinvent, its trillion-dollar ecosystem.

USTEC reached the 100% Fib extension at around 24955 before pulling back. The index is waiting for a possible breakout from the range 24800-24955.

If USTEC breaks above 24,955, the index may test the 161% Fibonacci extension at around 25,265.

Conversely, a return below 24700-24800 may lead to a retest of the moving average 21 and the lower limit of the channel.

Nasdaq’s balancing act

The Nasdaq 100 recently reached… 100% Fibonacci Extension around 24,955 Before retreating. The indicator is now standardized between 24800-24955waiting for the breakthrough.

- A move above 24,955 could open the way towards… Fibonacci extension 161% in 25,265.

- A drop below 24700-24800 may lead to a retest of the level EMA21 The lower border of the channel.

The performance of the index will ultimately reflect how these competing forces play out:

- Nvidia’s infrastructure investments are fueling demand for AI.

- The competition between Apple and Meta devices determines the next consumer platform.

- Microsoft’s consistent enterprise integration provides balance.

- Meta’s regulatory challenges add special risks.