Written by Stanislav Bernshv, the first trade content specialist in Exnes.

The Federal Reserve Week did not bring any significant change in the markets: the interest rate in the United States was left unchanged, with price cuts for 2025, which means that there are no surprises at the present time. Jerome Powell emphasized the flexibility of the labor market in the United States now.

The interest rate of BOE was also left unchanged, and the expectations match.

Although there are no surprises from the point of view of monetary policy, the geopolitical situation remains the most destabilized factors for all asset categories; Traders are trying to weigh US President Donald Trump about the situation in the Middle East and know whether the United States will interfere or not.

This has caused a declining reaction to crude oil contracts, thus getting rid of some geopolitical risk installments. The open interest in general for WTI oil contracts – every day within a week was decreased. Gold remained stable, and the total volatility in all fields was also silent: the narration of the “safe haven” momentum slows down, as the summer markets go in the absence of drivers.

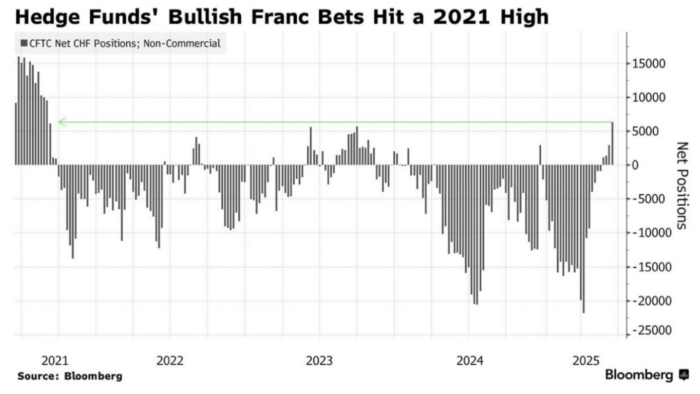

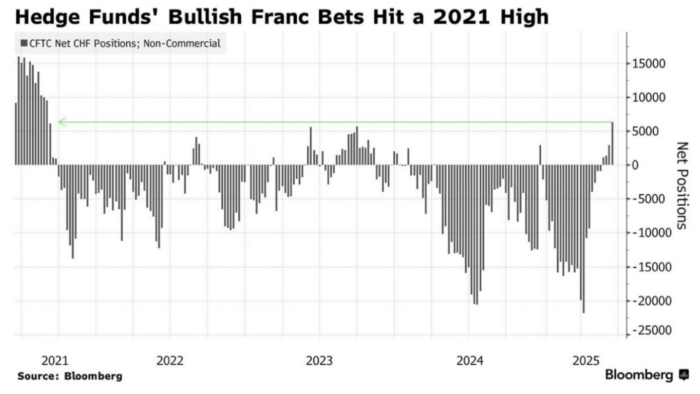

Interesting mode, however, construction may be on a Swiss franc. SNB reduced interest rates by a quarter -point (exactly as expected) and raised monetary policy to scratch. At the same time, the clear position of the speculators reached the peak, indicating the narration of “safe haven” in playing. The “risk” options (EURCHF stakes “have reached the new minimum, which may indicate a local bottom.

In conjunction with low benefits (although expected), this position may provide a great pressure for the Chif if capital flows from safe haven assets turned to periodic assets.

The Saudi bets of non -commercial merchants for Swiss Frank contracts. Source: Bloomberg.com

EURCHF

After losing fluctuations in a narrow trading range for several weeks, EURCHF may be ready to break. Usually, the pure position of speculators in the new peak, the perspective may be short -term of direction, while the medium -term image may indicate a reflection.

After dropping the interest rate from SNB, Swiss Franc loses its attractiveness as a safe origin of the haven, and the narration may turn into trade, which may weaken EURCHF.

Since the price is still being held inside the range despite the reduction of monetary policy, we can conclude that it may be ready to collapse soon as shown in the scheme.

EURCHF, Daily Chart. Source: Exnyss.com

Limol

After the initial penetration, the silver does not seem to carry the momentum, and you also do not get gold support either. Looking at the price position that touches the area over the Bolinger ranges for 20 days a week ago, it is possible to take into account that sliding further in the search for liquidity.

The spread between gold and silver is relatively low, which makes it rotate again (supposed in a form of low silver price).

The steady candlestick pattern confirms this scenario.

Xagusd, daily graph. Source: Exnyss.com