Ant International said on Thursday that she had a Bank Negara Malaysia money license, allowing him the Worldfirm platform to provide border payment services in the country.

Approval of WorldFirst enables the expansion of its product wing in Malaysia, and the support of small and medium -sized enterprises (SMES) with global payment groups, foreign exchange services and the Treasury Management.

The license adds to the Worldfirm wallet, which includes more than 60 organizational approvals all over the world.

“The license represents a great milestone in the commitment of WorldFirst in Southeast Asia, and most importantly, it enables us to serve small and medium -sized companies in Southeast Asia with better with safe financial services and compatible with the digital environmental system in the region,” said Clara Shi, Vice President of Ant International and CEO of WorldFirst.

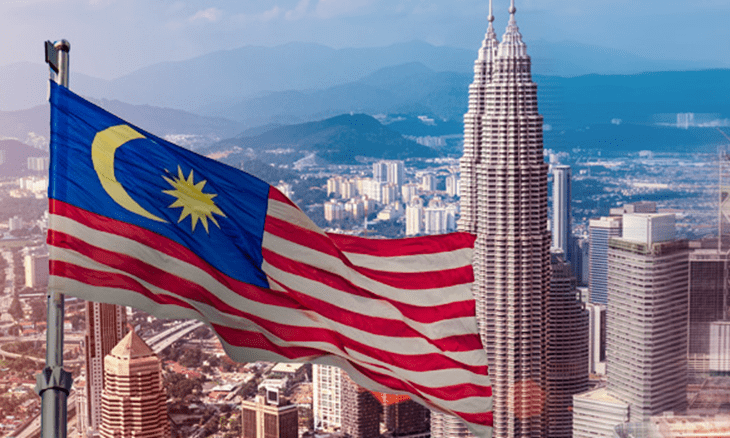

The digital economy in Malaysia has witnessed a rapid growth, as it is expected that the value of the total goods of e -commerce will reach 16 billion dollars by 2025 and 25 billion dollars by 2030.

A joint report issued by DELOTTE and WorldFirst defines the country as a “high potential market” for digital trade, driven by the high demand for the leveling of the fastest transactions, the competitive FX prices, and a wide range of payment options.

WorldFirst aims to meet these needs through its global pioneering account, which enables sellers to collect more than 130 global markets and allows buyers with international payments easily.

The company has also established local operations in Malaysia to better support small and medium -sized companies at the international level.

This step follows the broader strategic investment in Ant International in Malaysia, including launching a digital business center to take advantage of local technical talents for global innovation.