This post was presented by Stanislav Bernukhov, the first trade content specialist in Exnes

The current week in the financial markets was a week of reviving shares and US stock indicators: Nasdaq and S& P 500 arrived at high level after a ceasefire between Israel and Iran. Despite local tension and some missile exchange, the situation appears to have been resolved: according to Flightradar, the sky above Iran is already open, and markets calm down.

The rotation of the capital of American stocks was not completely reflected in other indicators: DAX, FTSE100 and Hang Seng have shown limited momentum, while the Japanese Nikki was more active, but it is still far from achieving the highest level at all times.

Thus, we can conclude that the narration of “selling America” is due to the agenda after resolving the crisis in the Middle East (at least at the present time). The revenue of the short treasury bonds at the beginning of the week indicated a “reflection of the spread of return”, but later in the situation improved.

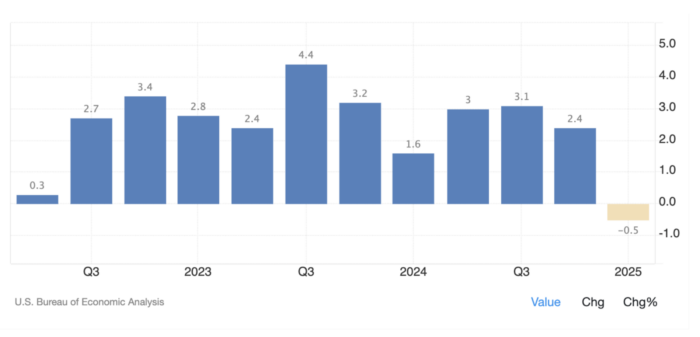

The US GDP contracts 0.5 % in the first quarter, 2025, according to the latest GDP report, which revived some recession fears, but not much, given that stock indicators climb into new peaks. Nevertheless, the probability of the interest rate remains unchanged in September 2025 decreases to less than 10 %.

This continues to pressure the US dollar, and reserves the demand for safe havens that are still at a very high level despite some optimistic optimism for periodic assets.

Today, in this article, we will focus specifically on the stocks, because they get the radar of the merchants with a decent bullish gathering.

CME

The financial sector maintains momentum with the technology sector.

With $ 1.64 billion revenues (+10 % year on year) and $ 2.80, a victory for expectations, shares get hedge and investment companies.

Net income exceeded one billion dollars, and ADV increased by 13 % on an annual basis to 29.8 million contracts, with standard volumes in all major asset categories – including prices, stocks, commodities and encryption.

From a technical point of view, the shares are placed around the fixed support level of $ 270. Looking at the general position of the financial sector is relatively low compared to the technology sector, we may expect to rise to the level of resistance of $ 290.

CME, D1. Source: Exnyss.com

Tme

Tencent Holdings Ltd. It is a giant of Chinese technology and entertainment, among the largest roof in the world. Its headquarters is located in Churchn, founded in 1998 by Pony MA and others. In Q1, TENCENT revenue increased by 13 % on an annual basis to 180 billion yen (about $ 25 billion), overcoming expectations. The net profit grew by 14 % to 47.8 billion yen, and the non -standard operating profit exceeded 18 %, driven by efficiency gains. All performance has been out of performance on games, Fintech, Cloud, and Media, which enhances the investor confidence.

It takes advantage of the recovery of artificial intelligence and shows strong momentum. The bullish trend may continue if the price is bounced from the lower line from an upward channel.

TME, D1. Source: Exnyss.com