Stonex makes a bold movement to unify its location through a special offer recently announced at a value of $ 625 million in the upper guaranteed notes due in 2032, a step directly related to its planned acquisition on RJ O’Brien & Associas (RJO), which is the oldest and oldest independent independent mediation companies in the United States.

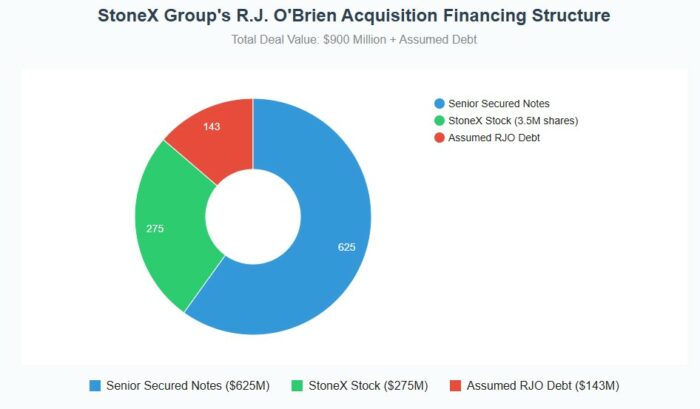

The notes, which will be issued by Stonex Security Source, a fully -owned subsidiary that has been created specifically for this purpose, will be presented for qualified buyers under the base 144A, and for non -affiliated persons. Expenses. The acquisition, which is estimated at about $ 900 million (including cash, shares and supposed debts), is a major expansion of Stonex.

This step is not without a precedent. In March 2024, Stonex successfully closed guaranteed notes of $ 550 million offered, indicating its ability to reach debt markets. However, the current offer is larger and is directly associated with the transformative acquisition, which leads to inflation.

RJO’s acquisition is expected to achieve great benefits for Stonex. It will add more than 75,000 customer accounts and about 300 brokers who provide two mediators to its network, which enhances its client by about $ 6 billion. More importantly, monotheism is expected to generate more than $ 50 million from synergy for expenditures and cancel the insurance of at least $ 50 million in capitalist synergy, according to Stonex. This places Stonex as a dominant global derivative company, which enhances its role across various asset categories.

However, the $ 625 million debt offer provides risks. The growing debt burden will increase Stonex’s financial leverage, making it more vulnerable to economic shrinkage and interest rate fluctuations. The incorporation of RJO operations successfully and the realization of expected synergy is very important, but it is not guaranteed. The market reaction is likely to rely on the debt supply and acquire them on several factors, including the final notes, speed of the regulatory approvals of the RJO, and Stonex’s ability to show progress in integrating the two companies. While the acquisition carries a great promise, investors must carefully consider the risks associated with it before making any investment decisions.