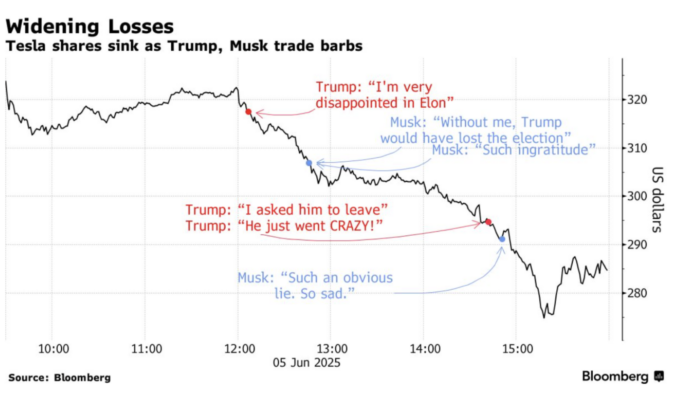

The markets seem to be affected by “social media wars” and data. The beginning of the week was affected by US President Donald Trump, who claims that China was not easy to negotiate (this strengthened the Japanese yen against Greenback). The second part of the week was often dominated by Elon Musk and his data on Twitter. Below is a collapse of this confrontation in X.

Nowadays, the trader must monitor these situations and adapt quickly: cut some purchase in such cases. In the past, the market was adapting to the so -called “Trump style” (increased volatility, then release tension), and now we can already talk about Trump Mossk.

Trump Musk’s confrontation. Source: Bloomberg.com

The NFP post was strong, but it is not large enough: 139K versus 130 expected. The market reaction was the growth of the S&P 500 shares and the United States (which fits the current trend), because the report was not the game changed.

Bond revenues decrease all over the world, as the level of volatility stabilizes, despite political talks. The markets are transmitted to a summer system: according to historical studies, fluctuations nails usually occur in late July, while in June, the procedure may be somewhat silent, with the lack of news and hot driving news players.

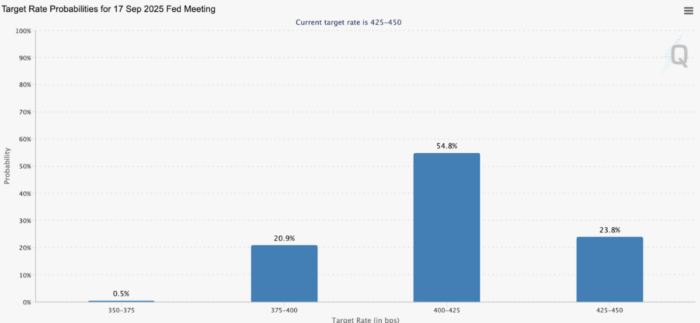

U.S. interest rates of interest indicate a single step in September, according to Fedwatchtool, with a clear bias for more than 50 % of the vote for this scenario, and about 20 % for the interest price reserved at the same level.

Interest rates for the month of September 2025. Source: https://www.cmegroup.com/markets/interest-raates/cme-fedwatch-tool.html

US500

The S&P 500 index focuses in the huge triangle under the psychological level of $ 6000, and given the neutral morale to the good market, it is not expected to decrease from this area before testing an area of 6000 and 6200 dollars. If the outbreak of this area occurs, then it is not expected to be sustainable and may return quickly to the range, as merchants are completely careful at the present time and the market is subject to references and take quick profits.

US500. Source: Exnyss.com

GBPJPY

The interesting story may be evolving around the Japanese yen and her husbands (especially against European currencies). GBPJPY, for example, focuses within a huge trading range, where the fluctuation of this pair has decreased to the lowest level in one year.

The revenues of the bonds for 30 years of Japan had peak up to the highest historical level, but now they begin to bounce. It seems that the clear position of the great speculators of the Japanese future on COT comparisons indicates the excessive position, which may lead to a rapid discharge of length and yen sliding quickly, which may lead to fluctuations from fluctuations and rapid collapse of GBPJPY and similar pairs.

The Trump-Moussa first model appeared on Leprate.