Served by Market President FP Aaron Hill

Safe armed assets have received a strong offer in the last trading, and directing immediate gold to the highest level of 3,220 USD/Troy Oid against the US dollar (Xau/USD). This shift towards safe deception markets was driven by the most softening demand for the US dollar, as the markets fled from dollar assets, in addition to the escalation of trade tensions between the United States and China. It is not surprising, the Swiss franc (CHF) and Japanese yen (JPY) also attracted big offers, as the USD/ChF pair recorded about 4.0 %-the largest decrease for one day since 2015!

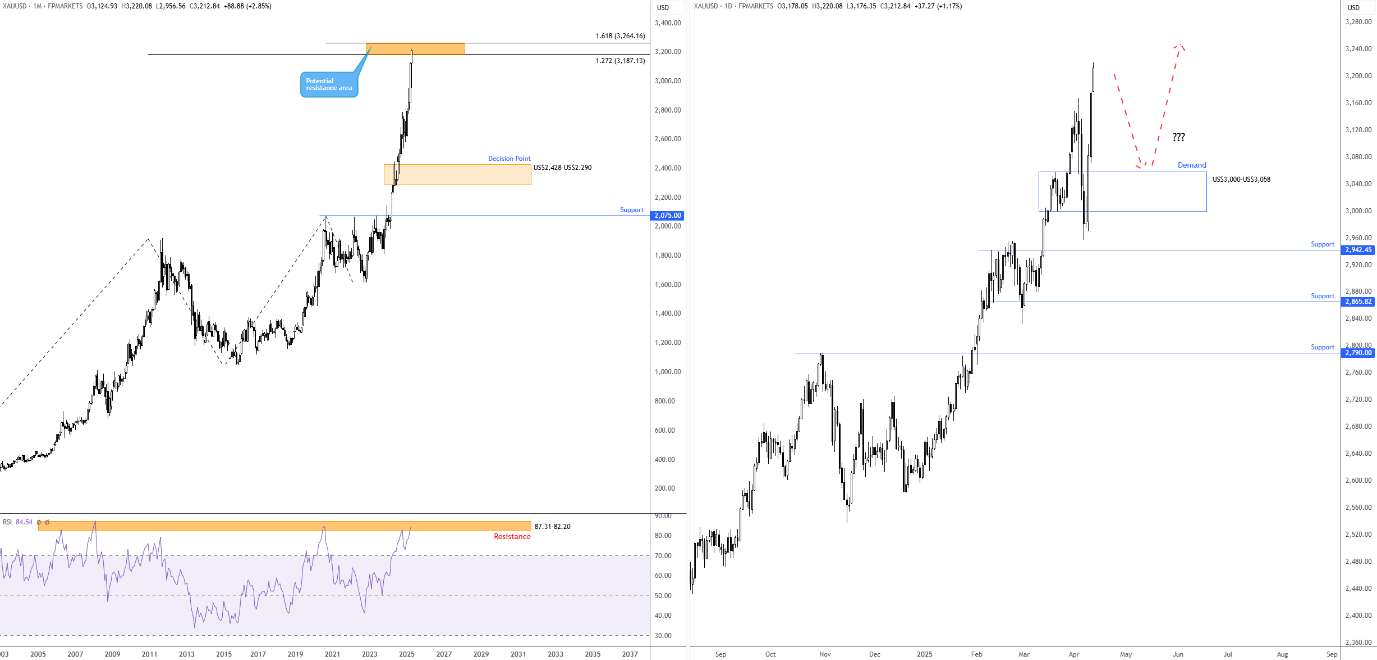

Monthly resistance and monthly sales conditions

According to what was reported, many offices are looking for 3500 US dollars as the next pastoral goal for gold; However, the monthly graph reveals that it has been greatly purchased according to the RSI Index. You will notice that RSI has been inside the peak area of the purchase since mid -2014 and touched the gloves recently with a familiar resistance between 87.31 and 82.20. This region has historical importance since 2006, and every time the index approaches the resistance, it usually follows a temporary correction/stop in the yellow metal. Thus, it raises the question about whether the purchase is set to moderate/stopping in the monthly resistance area between 3,264 USD and 3,187 USD (consisting of 1.618 % and 1.272 % of Fibonacci projection rates, respectively)?

Daily demand area; to retreat?

Meanwhile, on the daily chart, the procedures in Price came in throwing stone to test support from 2942 USD at the beginning of the week before gathering to the highest levels mentioned above. What is interesting from a technical perspective is that the step left behind in the demand area of $ 3,000-3,058 dollars, which, in my opinion, represents a major technical area.

With gold firmly firmly in a strong upward direction, buyers from the daily demand area can appear in the event of a correction. However, given the technical indicators on the monthly graph that indicates that buyers can pump brakes, it is possible that any activity is being dealt with to purchase a retreat with caution. COnfirmation – Such as the signal of the upscale candles or the price support on the low time frames – it may be needed before the trigger is withdrawn. However, any movement lower than the aforementioned demand zone signals involve a force from the monthly resistance area, and may open the door to short -term sales opportunities, targets daily support at a price of $ 2942, and is closely followed by support in the amount of $ 2,865, and perhaps $ 2,790.

Plans created using Tradingview

Slip:

The information in this article is dedicated to general advice only. It does not take into account your investment goals, financial situation or special needs. FP markets made every effort to ensure

Information accuracy as on the date of publication. FP markets do not give any guarantee or representation regarding materials. The examples included in these materials are for illustrative purposes only. To the extent permitted by the law, the FP markets and its employees will not be responsible for any loss or damage in any way (including by neglect) from or with regard to any information provided in this article or has been deleted. The features of the FP market products, including the fees and fees in force in the product detection data available from the FP Markets, www.fpmarkets.com and must be taken into account before

Decision to deal with these products. The derivatives can be risky. The losses can exceed your initial payment. FP Markets recommends an independent advice. First PRUDENTIAL Markets Pty Ltd Trading As FP Markets Abn 16

112 600 281, Australian financial services license number 286354.